Portfolio Rotational

Nasdaq 100

“Which strategies allow to maximize performance on an index by trading on its components?”

“How can I reduce portfolio drawdown without giving up returns?”

"Can I use systematic trading to manage my portfolio?"

These are just some of the questions systematic traders who work with stocks ask themselves.

Being able to answer these questions means you’ve already made significant progress in your trading career, but in order to do so you must have a clear idea of the real dynamics of the stock markets.

Spending many years in developing and testing different quantitative models applied to stock trading lets us answer these questions and understand what actually works in the stock markets and which strategies shouldn’t be used.

The aim of our rotational trading model is to achieve a good balance between returns and portfolio volatility, avoiding overexposure in a specific Asset Class such as the stock one, which is highly volatile, and keep risk under control.

This is an essential aspect that should NEVER be overlooked. Returns and Risk should always be balanced in a professional approach to trading.

Rotational Trading: why is it so important?

One of the primary goals of every trader is to diversify investments properly, by creating a portfolio with the right mix of strategies and financial products. It’s essential to avoid overexposure... and maximize portfolio performance without increasing risk!

Our rotational portfolio model allows for the diversification of strategies using two different trading models that work on the markets. These strategies are the medium/long term momentum, which consists in buying stocks based on their strength, and the inverse relationship between stocks and bonds, which allows for a good balancing of the portfolio through the Risk Parity algorithm.

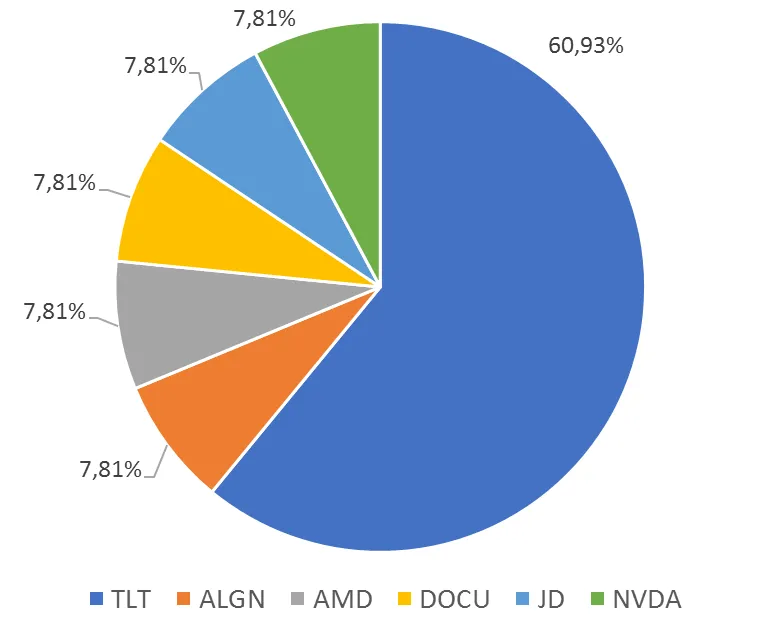

To achieve a good balance between returns and portfolio volatility, the rotational trading model uses the TLT – an ETF whose underlying constituents are US Bonds – to counterbalance the stocks in the portfolio.

The combination of these two strategies can maximize portfolio performance on the Nasdaq 100 Index in terms of risk-reward ratio (the ratio of our portfolio is twice as much as that of the benchmark!).

The final result is a portfolio that has higher profits than the main basket but with remarkably lower volatility.

“Risk” is an innate part of any type of financial investment. Andrea Unger often underlines how all his trading “is based on risk control”.

The job of a good trader is to manage the risk associated with his/her trading systems properly.

That’s why using a Rotational Trading model is so important; it lets each trader distribute his/her capital in various stocks – selected using two different quantitative models – creating a portfolio in which stocks and bonds are well-balanced.

Our Rotational Trading model allows the trader to:

- Distribute his/her capital in various types of investments

- Diversify his/her portfolio creating a well-balanced mix of strategies and financial products

-

Keep risk under control and avoid overexposure in one particular financial sector

The Algoritmica.pro Model

It takes a long time to create a Rotational Trading model. To do so, in fact, you need to have acquired a level of theoretical knowledge and practical know-how that can’t simply be achieved in a day .

One solution is to use the Rotational Trading model developed by Algoritmica.pro!

Ours is the only model approved by Andrea Unger, the four-time Trading World Champion.

What exactly is it?

Our model combines different types of portfolios offering time-tested reliable and consistent results.

We chose the models favoring simplicity over complexity – as this is the best way to ensure a coherent portfolio behavior in the future in relation to backtesting – and privileging the models that produce the best and most stable results considering risk and not only total performance.

We also believe that the simplicity of strategies and the time it takes to use them in the market are important for every investor. For this reason, portfolio management consists of a single monthly rebalancing operation.

How can you benefit from our model?

It can help you invest using up-to-date statistical/algorithmic models in an autonomous way outside the traditional financial circuit, which in recent years has clearly proven to be inefficient.

Portfolio composition and performance

The portfolio is made up of US bonds from the Nasdaq 100 Index, which were chosen using a quantitative momentum-based stock selection system, and the TLT, a US bond ETF.

The following test is Survivorship Bias free; this means that performance calculation takes into consideration also those assets that were once part of the Nasdaq 100 Index but that were delisted due to different reasons and are no longer part of it.

If we take a closer look at the model, the cumulative profit curve on a monthly basis shows a notably regular performance, especially when compared to the benchmark (SPX).

Note: these results are made WITHOUT using LEVERAGE.

This is the monthly portfolio performance:

While it’s true that the model shows quite limited volatility on a monthly basis, the investor shouldn’t forget that during turbulent market phases the volatility of the portfolio will undoubtedly be higher than end-of-month values. For this reason, we’ll also show you the equity line on a daily basis in detail (which isn’t often shown).

Especially during phases when stock markets suffer a severe drawdown, the model manages to limit the portfolio drawdown by dynamically adjusting portfolio weights in favor of safer asset classes such as bonds.

Annual portfolio performance in relation to the benchmark is shown below, and you’ll see there are years when the portfolio makes less profit, but it produces excellent performance when the benchmark is in difficulty.

Last but not least, the historical performance, with a C.A.G.R. and a return on invested capital in line with the benchmark, a moderate maximum drawdown, low portfolio volatility, and a Sharpe ratio higher than 1.30, are generally better than the SPX (benchmark), especially if we consider parameters such as the Sharpe and Sortino ratios that compare returns and risk.

This Rotational Trading model is intended for all those long-term investors who want to seize the opportunities the stock market has to offer and limit the volatility that is typical of stock portfolios without dedicating too much time to portfolio management.

Compared to the classic approach to trading, the timing of the entry and exit points of the position will be less important, letting the investor add capital (in the form of an accumulation plan for example) or withdraw capital when needed without having to worry too much about the current market climate.

Harmonized and Not-Harmonized ETFs

The harmonized adjective applied to a financial instrument basically means that it complies with current European legislation. They are generally listed on European Stock Exchanges, while non-harmonized ETFs are listed on non-European Stock Exchanges.

What will I get from this service?

Monthly Emails to rebalance your portfolio: on the first day of each month you’ll receive the new portfolio weights and the new assets to include in your portfolio when the markets open

Extras: periodic analyses and multimedia videos with the latest on Rotational Trading

Orders Example

Example of monthly table with instructions to rebalance the portfolio

How to Read Monthly Signals Emails

Who is this service for?

- You can invest at least $10,000

- You want to manage your capital yourself, through monthly portfolio rebalancing operations

-

You want to invest your capital using quantitative models, rather than leave everything in the hands of a Bank consultant

Why Algoritmica.pro?

Per rispondere a questa domanda abbiamo deciso di far parlare chi il servizio lo ha provato e chi sa cosa ci sta dietro. Non parole a vanvera o inutili promesse, ma le opinioni REALI di altri trader che seguendoci hanno davvero cambiato la loro vita.

Algoritmica.pro is the ONLY company certified to use The Unger Method™ to sell stock exchange signals.

AlgoInsider is ideal for people who don’t have time to study markets and want to dedicate just a few minutes a month to apply a scientific method to their trading.

Andrea Unger - The only Four-Time Trading World Champion

NON SI PUO' METTERE QUESTO! <<<<<<<<<<

PETRA ILONA ZACEK - Campionessa del Mondo di Trading 2018

“Consiglio certamente di seguire tutti i programmi di Andrea. ll motivo principale per cui lo dico è perché Andrea è una persona vera e un autentico trader…Avendo vinto i campionati di trading più e più volte, ripetutamente, la sua esperienza è ben comprovata…. Con Andrea fai un vero affare: ha dimostrato di sapere come far uso di tali mercati e puoi davvero avere molto successo con lui.”

STEFANO SERAFINI - Campione del Mondo di Trading 2017

".. Andrea entra molto nel dettaglio e tra l'altro si lascia scappare anche delle cose che arrivano solo dall'esperienza... Io lo raccomanderei a tutti... Nel mondo della finanza purtroppo c'è tanto fumo, c'è tanta gente che si spaccia il miglior trader del mondo, pur non avendo mai dimostrato nulla... Quindi, quello che secondo me va fatto è seguire persone che hanno dimostrato di saper fare, proprio come Andrea Unger."

Cosa aspetti? Iscriviti subito qui sotto!

Asset Allocation Mensile

19,70 euro

al mese

Riceverai MOLTO PIU' DI UN SERVIZIO SEGNALI...

- Email mensili per ribilanciare il tuo portafoglio

- Report settimanali sull'andamento del tuo portafoglio

-

Approfondimenti periodici sul mondo dell'asset allocation

- BLACK FRIDAY BONUS Extra con l'acquisto dell'abbonamento annuale: riceverai anche il Manuale + video corso omaggio "AFFRONTA I MERCATI CON I TRADING SYSTEM"

Passo n°1: Informazioni di Contatto

Nome:

Cognome:

Indirizzo Email:

Numero di Telefono - per il Corriere:

(comincia col prefisso internazionale, +39 per l'Italia...

es. +393331234567)

Passo n°2: Indirizzo di Spedizione

Indirizzo:

C.A.P.:

Città:

Provincia:

Nazione:

Passo n°3: Check out

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Frequently Asked Questions

Investing Club Reserved Area:

https://learn.ungeracademy.com/lessons/monthly-rotational/

Q: Where can I find the weight percentages that are always updated with the current portfolio composition?

A: On the first day of each month, you will receive an email containing the updated table. That said, you can also retrieve this information at any time by consulting the dedicated page in the reserved area of the Investing Club (link is found at the beginning of the FAQ)

Q: Should the financial instruments listed in the table be purchased with a specific broker?

A: The tutorials are presented on the Interactive Brokers TWS platform, but you can use any broker that allows you to buy and sell the financial instruments contained in the service

Q: Does the service involve using a stop loss?

A: These are balanced investment models, so exposure on Stocks is offset by TLT ETF

Q: When and how should I buy the instruments that make up the portfolio?

A: Purchases and sales must be made on the first day of the month when the markets open. As a type of order, we suggest that you use limit orders and place them in the "middle price range" of the book. For additional information, we invite you to watch the video in the reserved area of the Investing Club (link at the beginning of the FAQ)

Q: Do I need to close all positions and reopen them every month to rebalance the portfolio?

A: No, it is sufficient to verify the number of positions required for a specific instrument (ETF and Stocks) and act accordingly. If, for example, 10 ETFs are required and you already own 8 you will simply have to buy 2 (buy). It is not necessary to close (sell) the 8 existing positions and open (buy) all the 10 required contracts at the same time

Disclaimer:

The information herein does not promote public savings or any type of investment or business, nor does it promote or place financial instruments or investment services or bank/financial products/services.

The User makes use of the data and information in the email to take personal trading decisions at their own risk and under their own responsibility. Before making any bank/financial transaction based on information obtained – directly or indirectly – from the Web Site, the User should check said information is true and correct, and make sure the transaction is suitable to meet their personal requirements, and for their economic, financial and income situation.

The contents of this web site – including the tradenames, data, news, information, images, graphics and designs – are the property of Algoritmica.pro and are protected by copyright.

Past returns are not indicative of future performance.

The data and information on this web site are provided merely for illustrative purposes. The User may not record or save part or all of said content on any type of medium, reproduce, copy, publish or use the content for any commercial purpose without prior authorization .

Algoritmica.pro S.r.L. - Via Udine 3/2, 40139 Bologna, Italy - Tax Code/VAT: IT08203580967 - REA: BO-513389

Full paid-up Share Capital: 10.000,00 euro i.v. - Privacy Policy

Algo Insider authorization Court of Bologna n. 8400 of 18/11/2015 - Editorial Director: Andrea Angiolini

AGCOM registration ROC 26408 on 21-04-2016 | ISSN 2531-6923

Algoritmica.pro can not and do not make any guarantees about your ability to get results or earn any money with our ideas, information, tools, or strategies.

Nothing on this page, any of our websites, or any of our content or curriculum is a promise or guarantee of results or future earnings, and we do not offer any legal, medical, tax or other professional advice. Any financial numbers referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, exact earnings, or promises for actual or future performance. Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. You alone are responsible and accountable for your decisions, actions and results in life, and by your registration here you agree not to attempt to hold us liable for your decisions, actions or results, at any time, under any circumstance.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.