DAILY Stocks

The Algoritmica.pro Nasdaq 100 signals service is a swing trading strategy based on a mean reversion logic in which trades are usually held for a few days.

The system features different protection mechanisms, a trend filter, and two volatility filters that consider both historical and implied volatility. This means that the system stops when the market moves in a way that deviates too much from its standard moves.

We favored risk management over overall profit and performance to avoid particularly turbulent market phases that could wipe out the profits of many years in just a few months.

This is a time-tested system that was created in late 2016. The results it has produced since it has been active in the real markets lived up to the expectations that aroused during its development. It was almost unharmed by the two major crashes that took place in 2018 (in early February and from October to December) and proved its worth during the 2020 COVID-19 crisis that caused the markets to go down of -35% in a bit more than just one month.

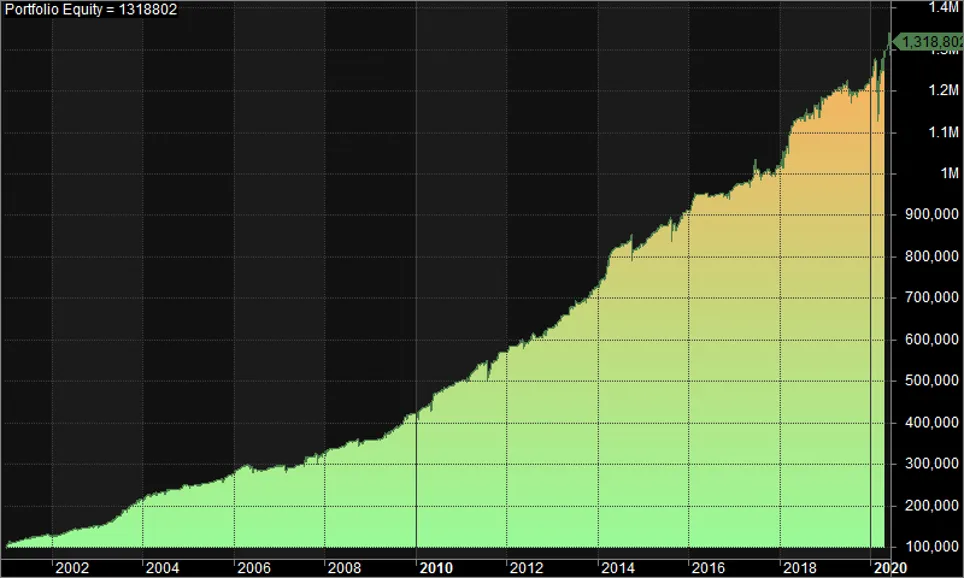

The equity line of the system clearly proves the enviable regularity of its performances, especially when compared to those of the Nasdaq100 basket of reference.

The equity curve with drawdown of the NASDAQ 100 signals service system

The equity curve of the basket of reference (QQQ)

The main metrics of the trading system are calculated on a basis of $2,500 per trade and allow for an in-depth analysis of performances.

The Net Profit/Drawdown ratio higher than 13 is particularly worthy of attention, as it’s quite unusual in this type of trading system.

This ratio further increases if, given the short duration of the trades, we consider the close to close Drawdown of all trades.

The validity of the system is further confirmed by the profit factor, which is greater than 1.7 and the average trade, which is 0.63% of the capital invested in each trade.

==> Download the Perfomance Report HERE

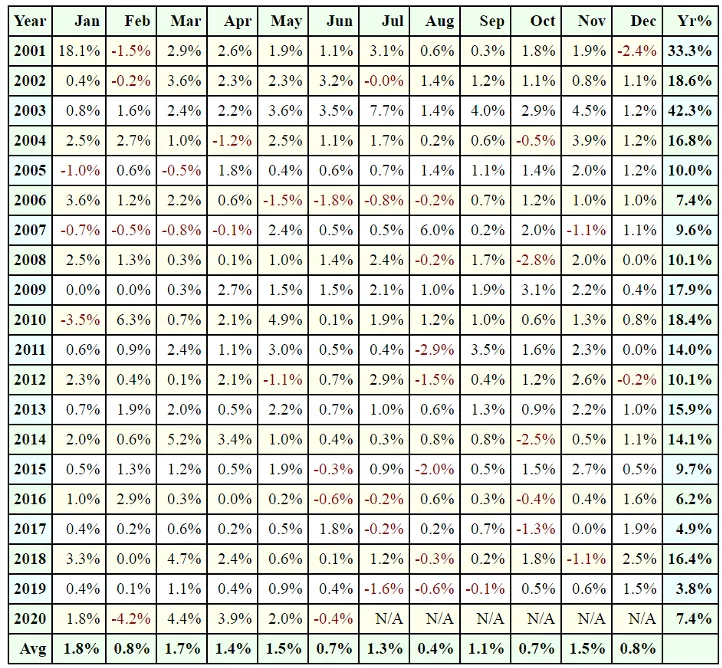

Annual Returns

Below, you can see the monthly returns calculated assuming an investment of $2,500 in each stock.

Monthly Returns

Monthly profits in percentage from 2001 to June 2020

Last Results and Trades

Last trades equity line with trade list.

Backtest survivorship bias free

To make sure the system is really effective, we decided to run one more test taking into consideration the historical composition of the Nasdaq100 basket as well.

Our purpose was to avoid the so-called survivorship bias; this is essential when we test stock portfolios, as stocks that are no longer listed in the basket may affect the results of backtests consistently.

This test, which we intentionally performed considering the reinvestment of profits, produced results that are in line with those we showed above.

Equity line without survivorship bias

Monthly profits in percentage from 2001 to June 2020

How the service works

At the end of the day, users will receive an email with: the orders for the following day, the new positions to open, and how to manage already open positions.

There can be a maximum of 10 open positions at the same time.

That said, on rare occasions, the number of orders in emails can exceed 10. In this case, all orders must be put in the platform. The reason is that these orders are conditioned (they are LIMIT orders) and they are executed only when the market reaches the price level specified in the email. According to backtesting, over the last ten years, this model would have achieved its maximum portfolio exposure (10 bought stocks) only twice per year.

If during the day, the maximum of 10 open positions is achieved (maximum margin exposure), pending entry orders must be cancelled (when this happens, our users will automatically receive a notification).

Of course, there are also days when the market opens on a gap down. When this happens, it is impossible to cancel pending orders in time (when the maximum of 10 open positions is reached), so the number of orders could (if there is enough capital) exceed the maximum number of open positions in the portfolio.

In this specific case, the best thing to do is to close the whole portfolio at the end of the day. The total dumping of all positions will protect the portfolio, as high volatility days are the most dangerous (in this case, too, users will receive a notification).

To sum it up: every day, before the markets open, you will receive an email with the signals; rarely, during an active session, you may receive an email telling you:

1. To cancel pending entry orders because you reached 10 positions (*);

2. To close your whole portfolio at the end of the day because you exceeded 10 open positions.

(*) You generally receive this email when your tenth order is being executed. In case it is impossible to cancel pending orders immediately, you can simply close the open positions that exceed the maximum of 10 – they will be specified in the email – before the session ends.

The second situation is rarer than the first. Generally, it occurs only when there is not enough time to cancel the orders and avoid having more than 10 open positions at the same time. In this case it is still necessary to cancel the pending buy orders after having received the communication about the whole positions closure.

The average number of open positions at the same time is less than 2. This is a non-intensive use of the trading capital that allows you to use this system together with other trading strategies.

The leverage of the portfolio is 2, and it was calculated by assuming a minimum capital of $12,500. So, considering an investment of $2,500 in each stock, you can buy at most 10 stocks (reaching the maximum exposure needed to follow this signals service).

We calculated the leverage of this portfolio by considering that the average use of capital is quite low. Moreover, almost any broker allows for a leverage of 2 on stock investments .

Below, you can see the email you will receive every day before the market opens. The email will be divided into three parts: orders, stocks in your portfolio, and closed trades.

An example of a daily email with trading guidelines for the next day

These quantities are just an example and correspond to the proportions used in the simulation, assuming an equal capital division.

How to Read Daily Signals Emails

To make it easier for users to enter orders and manage the entire process, Interactive Brokers clients will have the possibility to enter all orders with just one click, using our file that is specifically formatted to be imported in the Basket Trader tool on the TWS platform.

You can find the link for the file specifically formatted to be imported in the Basket Trader both in daily email and in your reserved area.

==> Nasdaq100 Stocks Signals Reserved Area HERE

What will I get from this service?

Daily emails with signals for the following day: On days when the stock exchange is open, you will receive the trades you should enter in your trading platform before the markets will open on the following day

Extras: Periodic analyses and multimedia videos with the latest news

- Can invest at least $12,500

- Want to manage your capital dynamically, once a day

- Want to invest in stocks

Why Algoritmica.pro?

Per rispondere a questa domanda abbiamo deciso di far parlare chi il servizio lo ha provato e chi sa cosa ci sta dietro. Non parole a vanvera o inutili promesse, ma le opinioni REALI di altri trader che seguendoci hanno davvero cambiato la loro vita.

Algoritmica.pro is the ONLY company certified to use The Unger Method™ to sell stock exchange signals.

AlgoInsider is ideal for people who don’t have time to study markets and want to dedicate just a few minutes a day to apply a scientific method to their trading.

Andrea Unger - The only Four-Time Trading World Champion

Cosa aspetti? Iscriviti subito qui sotto!

Azionario Giornaliero

147 euro

al mese

Riceverai MOLTO PIU' DI UN SERVIZIO SEGNALI...

- Email giornaliere con i segnali per andare a mercato

- Report settimanale sull'andamento del tuo portafoglio

-

Approfondimenti periodici sul mondo dell'asset allocation

- BLACK FRIDAY BONUS Extra con l'acquisto dell'abbonamento annuale: riceverai anche il Manuale + video corso omaggio "AFFRONTA I MERCATI CON I TRADING SYSTEM"

Passo n°1: Informazioni di Contatto

Nome:

Cognome:

Indirizzo Email:

Numero di Telefono - per il Corriere:

(comincia col prefisso internazionale, +39 per l'Italia...

es. +393331234567)

Passo n°2: Indirizzo di Spedizione

Indirizzo:

C.A.P.:

Città:

Provincia:

Nazione:

Passo n°3: Check out

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Offerta Speciale:

La rivista mensile di trading più grande d'Italia

Il Circolo dei Trader include:

-

Rivista mensile cartacea (12 copie) per un anno solare direttamente a casa tua

-

Rivista digitale visibile nella tua area riservata durante l'anno solare

-

Approfondimenti multimediali nella tua area riservata durante l'anno solare

- BONUS OMAGGIO: evento annuale dal vivo per tutti i soci del circolo

-

BONUS OMAGGIO: manuale "AFFRONTA I MERCATI CON I TRADING SISTEM" che ti illustrerà cosa sono (e cosa non sono) i Trading System, pietra miliare del metodo Unger™ con cui tutti i nostri servizi segnali sono stati sviluppati.

[Scelto dal 20% dei nostri Studenti]

Il suo valore è di 228€, tuttavia, e solo in quest'occasione, può essere tuo per soli 167€.

AGGIUNGI il Circolo dei Trader al tuo carrello e riceverai anche il manuale "AFFRONTA I MERCATI CON I TRADING SISTEM".

Frequently Asked Questions

Investing Club Reserved Area:

https://learn.ungeracademy.com/lessons/daily-nasdaq-top100/

Where can I find the day's trading signals?

Signals are sent via email every day after the markets close. They are also published in the reserved area of the Investing Club.

Do I need to have a specific broker to be able to follow signals?

It is not necessary to have a specific broker to follow the operating signals. However, Interactive Brokers/Mexem clients have the ability to enter all orders with a single click, using the CSV file specially formatted for the Basket Trader tool of the TWS platform.

It seems to me that the average trade is a bit tight. Do you find it broad enough?

It would be best if you consider that the average trade, as far as stocks are concerned, should be evaluated in relation to the capital invested. It's one thing to invest $2,500 per share (as in our case). Another is to trade one contract of mini S&P500, which corresponds to a notional amount of $175,000.

The stop loss is wide. Why is that?

The stop loss is wide because the driving force behind the strategy is created without a stop loss. Generally, if the trade goes into loss, it is closed with a limit order at the first slight upward retracement. However, we believe it is advisable to always have a stop loss, which in our case acts as protection against adverse market events.

How do I set a leverage factor of 2?

The broker offers leverage, and it is the broker who decides how much margin to use on different categories of underlyings. For the stocks on Interactive Brokers/Mexem, the overnight leverage is 2:1 and cannot be changed. Intraday it is more permissive and goes up to 2.5-3, but overnight it is fixed at 2, so on a $50,000 securities counterpart, you will have $25,000 of committed margin at closed markets. No more and no less, as this regulation comes directly from the SEC, which is the agency that oversees the stock exchanges.

Limit orders: what if they are not executed?

Entry orders are LIMIT and are only valid on the day they are posted (DAY duration). LIMIT entry at 439.72 means that until the market reaches that level, the order remains pending until the end of the day. If the market reaches the entry-level without exceeding it, the order may not be executed. In that case, we always consider the order as executed, so we suggest to the reader that they align with the theoretical operation.

Linked orders, OCO Group and bracket orders. After changing the account number and correctly importing the CSV file into Basket Trader, a strange thing happens to me: the number of shares to trade remains 100 for all of them. What could cause that?

When importing the file (included in daily signals) into the Basket Trader of Interactive Brokers/Mexem, the quantities are defaulted to 100. In the window that appears as soon as you upload the CSV file, be sure to check the boxes that say "do not round".

During the pre-market phase, if I am notified to buy LIMIT a stock that trades below the published level, what should I do?

In these cases, the limit order is always maintained at the published level. The opening will then be what decides whether the entry will be at market at the current price or not. If the opening is below the published limit level, the order will be executed at the opening price.

I would like to start following the trading signals. What should I do with the instruments already in my portfolio? Do I disregard closing orders on those stocks, or do I buy those instruments at the market open?

It depends on the price at which you would be able to make the realignment. However, the basic idea is to start from scratch and as new positions come in, align with the portfolio.

If a stock is listed for inclusion on October 15th and during the day it was not executed, as signals come in on the 16th and that stock is no longer on the new-to-enter list, should it be left pending for the 16th as well, or should it be removed?

The signals are valid ONLY for the current day. If not performed, they must be discarded. If you place orders via Basket Trader, they are automatically canceled at the end of the day.

Disclaimer:

The information herein does not promote public savings or any type of investment or business, nor does it promote or place financial instruments or investment services or bank/financial products/services.

The User makes use of the data and information in the email to take personal trading decisions at their own risk and under their own responsibility. Before making any bank/financial transaction based on information obtained – directly or indirectly – from the Web Site, the User should check said information is true and correct, and make sure the transaction is suitable to meet their personal requirements, and for their economic, financial and income situation.

The contents of this web site – including the tradenames, data, news, information, images, graphics and designs – are the property of Algoritmica.pro and are protected by copyright.

Past returns are not indicative of future performance.

The data and information on this web site are provided merely for illustrative purposes. The User may not record or save part or all of said content on any type of medium, reproduce, copy, publish or use the content for any commercial purpose without prior authorisation.

Copyright © Algoritmica.pro - All right reserved

Algoritmica.pro S.r.L. - Via Udine 3/2, 40139 Bologna, Italy - Tax Code/VAT: IT08203580967 - REA: BO-513389

Full paid-up Share Capital: 10.000,00 euro i.v. - Privacy Policy

Algo Insider authorization Court of Bologna n. 8400 of 18/11/2015 - Editorial Director: Andrea Angiolini

AGCOM registration ROC 26408 on 21-04-2016 | ISSN 2531-6923

Algoritmica.pro can not and do not make any guarantees about your ability to get results or earn any money with our ideas, information, tools, or strategies.

Nothing on this page, any of our websites, or any of our content or curriculum is a promise or guarantee of results or future earnings, and we do not offer any legal, medical, tax or other professional advice. Any financial numbers referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, exact earnings, or promises for actual or future performance. Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. You alone are responsible and accountable for your decisions, actions and results in life, and by your registration here you agree not to attempt to hold us liable for your decisions, actions or results, at any time, under any circumstance.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.